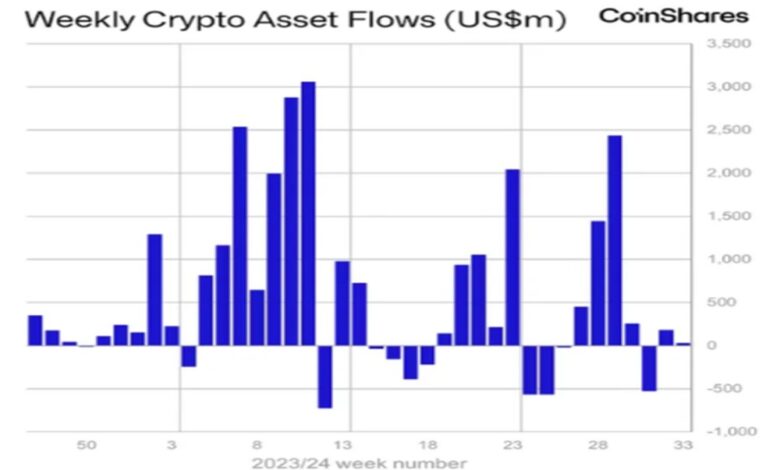

Institutions Resume Buying as Crypto Products Sees $30M Inflow Last Week

Digital asset investment products received a total inflow of $30 million last week, with $42 million flowing into Bitcoin and only $4.2 million flowing into Ethereum.

According to CoinShares, the crypto products landscape saw a modest total inflow of US$30 million last week, signifying a period of positive sentiments. However, a closer examination reveals a divergence in investment flows across different assets and regions, showcasing the evolving dynamics of the market.

Regionally, investment flows exhibited a diverse pattern. The United States, Canada, and Brazil recorded inflows of US$62 million, US$9.2 million, and US$7.2 million respectively, indicating a positive outlook for these regions.

Conversely, Switzerland and Hong Kong experienced significant outflows, totaling US$30 million and US$14 million, respectively, reflecting potential regional market specificities.

Crypto Products Trading Volume Plummets

The week saw a notable decline in overall trading volume, plummeting to US$7.6 billion, nearly half of the previous week’s figure. Furthermore, the drop was due to recent macroeconomic data suggesting a less aggressive stance from the Federal Reserve regarding interest rate cuts in September, influencing investor sentiment and trading activity.

Despite the overall inflow, established providers experienced a continued loss of market share to newer investment products. Additionally, the trend highlights the growing appeal of emerging institutional interest in digital asset investment opportunities, reflecting investor diversification strategies.

Bitcoin Gains Traction Amidst Market Instability

Bitcoin emerged as the top performer, attracting US$42 million in inflows, signaling strong investor confidence in the world’s largest cryptocurrency. Conversely, short-bitcoin ETFs saw outflows for the second consecutive week, totaling US$1 million, indicating a cautious approach towards shorting Bitcoin.

Ethereum, despite a modest inflow of US$4.2 million, displayed a complex activity pattern. New providers saw substantial inflows of US$104 million, highlighting the growing interest in Ethereum-based investment products.

Conversely, Grayscale experienced a substantial outflow of US$118 million, reflecting potential shifts in investor preferences and strategies within the Ethereum investment space.

Solana, however, faced a significant setback, recording a record-breaking outflow of US$39 million. This outflow can be attributed to a sharp decline in trading volumes of memecoins, a key driver of Solana’s growth. The reliance on memecoins appears to be a double-edged sword, exposing Solana to volatility and potentially discouraging long-term investors.