Fed Chairman Powell Spur the Market into Flurry Whale Bull-runs

Powell remarks as a shift in focus from inflation control to maintaining a strong labor market, which had been focused on tackling inflation for the past two years, is nearing completion.

Federal Reserve Chairman Jerome Powell, in his keynote address at the Fed’s annual Jackson Hole retreat, signaled a shift in monetary policy, paving the way for potential interest rate cuts. While declining to provide specifics on the timing or extent of these cuts, Powell emphasized that “the time has come for policy to adjust.”

Despite the progress made on inflation, Powell cautioned that the task is not yet complete, vowing that the Fed will continue its efforts to maintain a strong labor market and achieve the Fed’s 2% inflation target.

Economists, like Paul McCulley, a former Pimco managing director, interpreted Powell’s remarks as a shift in focus from inflation control to maintaining a strong labor market.

The Fed’s decision to consider rate cuts comes as the inflation rate has steadily retreated toward the Fed’s target, though it remains slightly above it. A preferred measure of inflation used by the Fed recently indicated a rate of 2.5%, down from 3.2% a year ago and well below its peak of over 7% in June 2022.

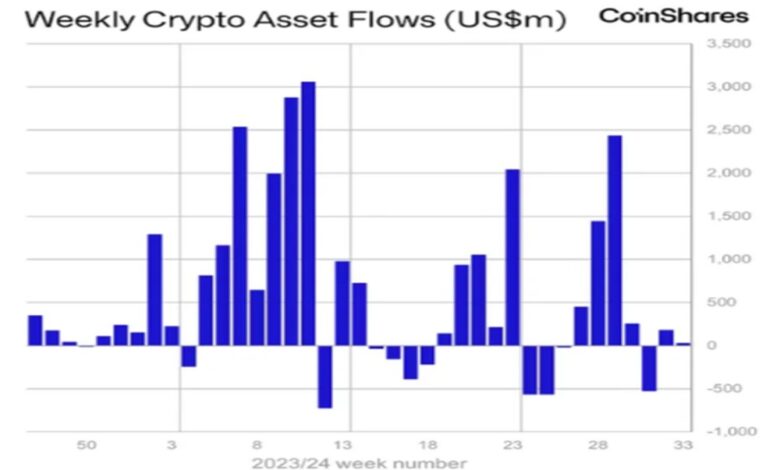

The speech was met with positive reactions from markets, with stocks rising and Treasury yields dropping sharply. Traders increased the odds of a rate cut in September, with some even anticipating a potential half-point reduction.

In the last 24 hours, BTC has surpassed $63,500, reaching an all-high of $64,358.86 causing increased activity among altcoins. Avalanche (AVAX) is up by 10% today, while popular cryptocurrencies like Shiba Inu (SHIB) and Dogecoin (DOGE) have seen gains exceeding 5%, according to coinmarketcap.

Flurry Whale Transactions After Powell Statement

The cryptocurrency market witnessed a flurry of significant transactions on [DATE], involving substantial amounts of USDT, USDC, and ETH. While the precise motivations behind these transfers remain unclear, the sheer scale of these movements has piqued the interest of the crypto space.

The most notable transaction involved a transfer of 100,090,720 USD worth of USDT (approximately 100,000,000 USDT) from an unidentified wallet to Coinbase Institutional. However, the move suggests potential institutional interest in acquiring USDT, a stablecoin pegged to the US dollar.

Another significant transfer involved 35,926,431 USD worth of USDC (approximately 36,000,000 USDC) moving from Binance, one of the largest cryptocurrency exchanges, to Coinbase Institutional. This transfer could indicate a shift in investor preference from Binance to Coinbase, or perhaps a strategic maneuver by an institutional player.

The flow of funds was not unidirectional. A subsequent transfer of 55,408,270 USD worth of USDC (approximately 55,366,745 USDC) moved from Coinbase Institutional to an unidentified wallet. This could suggest a potential arbitrage opportunity, a sale of USDC, or possibly a distribution to a specific client.

Further adding to the intrigue, 59,991,810 USD worth of USDC (approximately 60,000,000 USDC) was transferred from an unidentified wallet to Coinbase Institutional. This again indicates potential institutional interest in acquiring USDC, likely for trading or investment purposes.