Crypto Exchanges See Largest BTC Outflow in Months

Crypto exchanges saw outflows in the month reaching 51,000 BTC.

According to recent data, Bitcoin exchanges reserves have plummeted to historic lows, hitting levels not seen since October 2021. Popular cryptocurrency analytics platform, CryptoQuant, reported that major crypto exchanges experienced a significant withdrawal of over 51,000 bitcoins in the past month.

The drop in exchange reserves indicates a shift in market sentiment towards long-term investment, reflecting growing confidence in Bitcoin’s potential for future growth.

Crypto Exchanges Record Consecutive Weeks of Outflows

The recent record of high outflows is not an isolated incident, as Bitcoin exchange reserves have recorded several high outflows this month. Last week, Bitcoin’s exchange reserves decreased significantly, reaching 2.58 million BTC, the lowest level since 2018.

On Tuesday, in a remarkable resurgence, Bitcoin skyrocketed to its loftiest level since 2022, bursting through $68,000, though for a brief period, and triggered a massive $285.09 million liquidation cascade underscoring the market’s sensitivity to price fluctuations and its unyielding potential for growth.

Out of the affected crypto exchanges, OKX exchange saw the highest with liquidations worth about $6.55 million, which occurred on the ETH-USDT-SWAP pair.

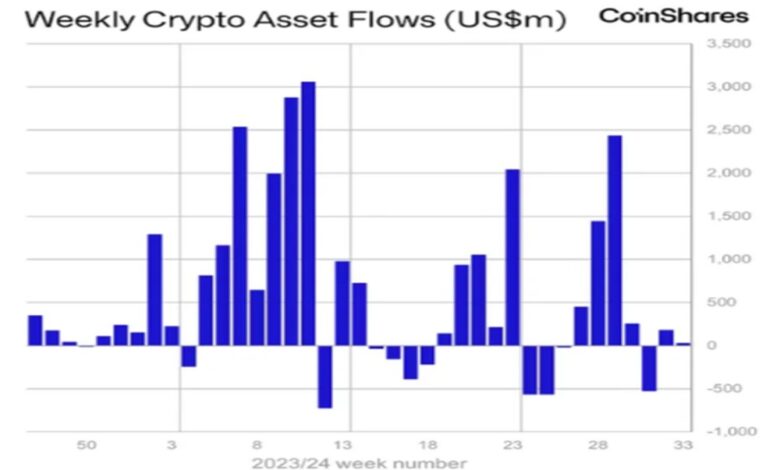

Institutional Crypto Investment Soars to New Heights

The recent surge in Bitcoin outflows from exchanges, reaching up to 51k BTC, suggests institutional investors are increasingly buying and securing Bitcoin in their wallets.

For instance, MicroStrategy, a leading business intelligence software firm, has maintained a bullish stance on Bitcoin since its inaugural purchase of 21,454 Bitcoins on August 11, 2020.

Last month, the company purchased 7,420 BTC worth about $458.2 million, increasing its total Bitcoin holdings to a staggering 252,220 BTC, worth about $9.9 billion at the time of purchase.

In a bold nod to MicroStrategy’s innovative strategy, Metaplanet Co., Ltd., a company headquartered in Tokyo, has also been making significant strides in the crypto investment space. Earlier this year, the Japanese company adopted a pro-bitcoin investment policy and has since then steadily accumulated Bitcoin.

The company has been quite aggressive in its Bitcoin purchases, with several notable buys in recent months. In July, Metaplanet added 42.47 Bitcoin, valued at about 400 million Japanese Yen (around $2.3 million at the time of purchase) to its treasury and another purchase of ¥1 billion worth of BTC (about $7 million at the time of purchase) this month.