Robinhood Announce Record-Breaking Third Quarter Results, Driven by Strong Revenue Growth

Net interest revenues saw a healthy increase of 9% year-over-year, reaching $274 million, primarily driven by growth in interest-earning assets

Robinhood Markets, Inc. (NASDAQ: HOOD) announced strong third-quarter 2024 financial results, showcasing a 36% year-over-year increase in total net revenues, reaching $637 million.

The result marks the second-highest revenue on record for the company. GAAP diluted earnings per share (EPS) also demonstrated significant improvement, rising to $0.17, a $0.26 increase compared to the same period in 2023.

The company attributed the robust revenue growth to a 72% surge in transaction-based revenues, driven by strong performance in options, cryptocurrencies, and equities trading.

Net interest revenues also saw a positive increase, rising 9% year-over-year, primarily fueled by growth in interest-earning assets.

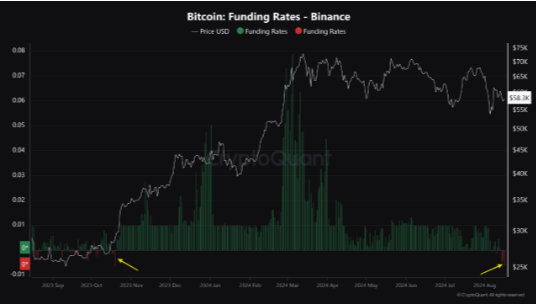

Moreover, the impressive performance was fueled by a robust surge in transaction-based revenues, which jumped 72% year-over-year to $319 million. This growth was primarily driven by significant increases in options revenue (up 63% to $202 million), cryptocurrency revenue (up 165% to $61 million), and equities revenue (up 37% to $37 million).

Robinhood’s success extended beyond transaction-based revenue. Net interest revenues also saw a healthy increase of 9% year-over-year, reaching $274 million, primarily driven by growth in interest-earning assets. Other revenues, primarily driven by Gold subscription revenue, grew by 42% year-over-year to $44 million.

Robinhood also saw notable growth in other key metrics. Funded Customers increased by 1.0 million year-over-year to 24.3 million, while Investment Accounts climbed to 25.1 million, reflecting a 1.5 million year-over-year increase.

Additionally, Assets Under Custody (AUC) increased by 76% year-over-year to $152.2 billion, driven by continued Net Deposits and higher equity and cryptocurrency valuations.

Further highlighting the company’s financial strength, year-to-date net deposits reached $34 billion, exceeding prior full-year records. Total revenues for the year are also exceeding previous full-year records, reaching $1.94 billion, with GAAP diluted EPS reaching $0.55.

Robinhood to Introduce Index Options and Futures

Beyond the financial figures, Robinhood demonstrated a continued focus on product development and innovation. The company launched its new desktop offering, Robinhood Legend, in October 2024, designed to cater to active traders.

Furthermore, Robinhood announced plans to introduce index options, futures, and a realized profit and loss tool in the coming months. The company also hosted its inaugural HOOD Summit, a customer-focused conference, showcasing its commitment to building a strong and engaged community.

“I’m really proud of our Q3 results and how smoothly our product engine is humming,” said Vlad Tenev, CEO and Co-Founder of Robinhood. “In the past month, we introduced Robinhood Legend, our new desktop offering, and announced index options, futures, and a realized profit and loss tool are coming soon. And just this week, we launched our Presidential Election Market.”

Jason Warnick, Chief Financial Officer of Robinhood, echoed Tenev’s sentiments, highlighting the company’s commitment to profitability. “Q3 was another strong quarter, as we drove 36% year-over-year revenue growth, and dropped most of that to the bottom line,” he said. “We entered 2024 with the goal of delivering another year of profitable growth, so we’re excited to have already broken prior full year records for both revenue and EPS.”