Bitcoin (BTC) Price Deflates Despites Establishing US Strategic Reserve

Bitcoin's price fell below $80,000 after Trump's executive order, disappointing investors who anticipated larger government purchases, triggering a market correction.

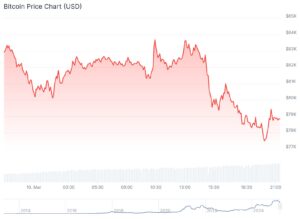

Bitcoin (BTC) price has experienced a downturn in the last 24 hours, falling almost 4.9% and briefly dipping below $80,000. Notably, this surge in panic selling among newer participants has exacerbated the price decline.

This four-month low follows increased market volatility, attributed by analysts to President Trump’s executive order establishing a US strategic cryptocurrency reserve, which includes Bitcoin.

Why is the BTC Price Dipping

As of Monday, March 10th, 2025, Bitcoin continues to fluctuate around the $80,000 mark. While currently experiencing a 3.9% rebound to $78,720.46, it remains down approximately 4.9% over the past 24 hours.

Bitcoin’s continued downturn follows a significant 6%+ plunge on Sunday, one of the year’s worst trading sessions. This drop established a new low for daily closes since November 2024, representing the weakest point in over four months.

President Trump’s recent executive order establishing a U.S. strategic Bitcoin reserve, funded by cryptocurrencies seized in legal proceedings, initially buoyed the market.

However, Investors’ unhappiness rose in opposition to market expectations because the government didn’t buy a lot of BTC—maybe 100,000 to 200,000 coins. The price went down, showing how much the market cares about what the government does (or doesn’t do).

Bitcoin’s price changes aren’t just about government rules; they follow what’s happening in the whole market. Experts at 10x Research said the recent drop was a normal correction. They think about 70% of the selling was from people who only recently bought Bitcoin.

Arthur Hayes, BitMEX co-founder, and Maelstrom CIO, predicted a potential retest of the $78,000 support level for BTC. He cautioned on X that a breach of this level could lead to a subsequent drop to $75,000, citing substantial open interest in Bitcoin options within the $70,000-$75,000 range.

Bitcoin Price Tracjectory

Bitcoin trading volume jumped a lot in the last 24 hours. The total was $57 billion, up 123.5% from the day before. This big increase shows more people are interested in Bitcoin, maybe hinting at a market change.

Bitcoin’s price has gone way up and way down. It reached a high of $108,786 and a low of $67.81. Right now, it’s 27.44% below its highest price, but still 116,303.19% higher than its lowest price according to CoinGecko data.

Even though it’s down 7.8% in the last week, Bitcoin is doing better than most other cryptocurrencies, which are down 9.6%. This shows some investors still believe in Bitcoin.