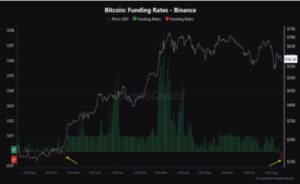

Bitcoin Funding Rates Plunge on Binance: Is a Downtrend to Follow?

The average Bitcoin funding rate, an indicator that aggregates funding rates across all exchanges, has also dipped into negative territory.

The cryptocurrency market is experiencing heightened volatility, with Bitcoin funding rates on Binance reaching their lowest levels year-to-date. This negative trend, extending for three consecutive days, has not been observed since October 2023.

The average Bitcoin funding rate, an indicator that aggregates funding rates across all exchanges, has also dipped into negative territory. This signifies a shift in market sentiment, with short positions gaining dominance in the perpetual market.

Binance, holding the largest share of open interest (OI), is a key indicator of overall market sentiment. The recent negative funding rates on the platform suggest a potential bearish outlook for Bitcoin in the short term.

Understanding Bitcoin Funding Rates

Funding rates, also known as interest rates or funding costs, are a key element of perpetual contracts. These contracts allow traders to hold long or short positions without an expiry date. Funding rates are charged to maintain the price of a perpetual contract in line with the underlying asset’s spot price.

Positive funding rates indicate a premium for holding a long position, reflecting bullish market sentiment. Conversely, negative funding rates indicate a premium for short positions, signaling a bearish market outlook.

Implications of Negative Funding Rates

The current negative funding rates on Binance, combined with the negative average funding rate across exchanges, suggest a growing prevalence of short positions in the market. This could potentially translate into downward pressure on Bitcoin prices shortly.

Nonetheless, “while negative funding rates can be a powerful indicator of market sentiment, it’s crucial to consider other factors before drawing definitive conclusions.” Market conditions can be dynamic, and other indicators, such as on-chain metrics and macroeconomic trends, should be analyzed alongside funding rates for a more comprehensive perspective” according to the source chart community data.

On August 2nd, 2024, the US government moved approximately $593.5 million worth of Bitcoin, confiscated from the infamous Silk Road marketplace, to a Coinbase Prime deposit wallet designated as 33J.

Moreover, the transaction, valued at 10,000 Bitcoin (BTC), originated from an address explicitly marked as ‘U.S. Government: Silk Road DOJ Confiscated Funds. While the government initiated the transfer, Coinbase did not receive the funds directly but through an intermediary. The exact nature of this intermediary remains undisclosed.