Fed Under Pressure – JPMorgan Predicts Early Interest Rate Cut

Amid escalating trade tensions and market volatility, JPMorgan Chase & Co. has raised its projection for the likelihood of a U.S. recession to 60%, up from a previous estimate of 40%.

JPMorgan has raised significant concerns about the Federal Reserve potentially having to lower interest rates ahead of its next scheduled policy meeting. This forecast stems from mounting economic pressures linked to global trade tensions, market volatility, and growing apprehensions regarding a possible economic slowdown.

Recent developments have considerably strained financial markets across the globe. In the UK, the FTSE 100 experienced a sharp 6% decline, representing its worst performance since March 2020.

Asian Market Sees Massive downtrend

Meanwhile, in Asia, Japan’s Nikkei index dropped by nearly 9%, and Taiwan’s stock index fell by 10%, prompting regulators to implement temporary trading halts and emergency measures. Analysts primarily attribute these steep declines to new tariffs imposed by the U.S. and fears of subsequent retaliatory actions by China.

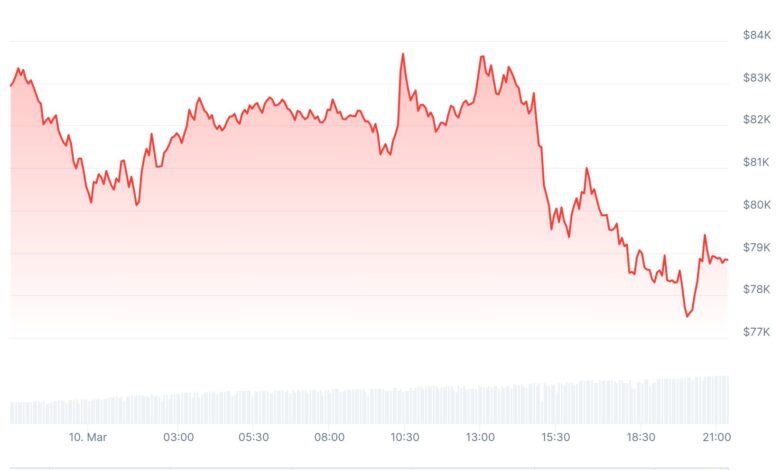

In the United States, stock market futures reflect similar distress. The S&P 500 futures plummeted nearly 5%, while Nasdaq futures decreased by a staggering 5.7%. Investors increasingly worry about the long-term ramifications of these disruptions on the economy. The CBOE Volatility Index (VIX), which gauges market anxiety, surged to its highest level since the early days of the COVID-19 pandemic, signaling heightened uncertainty among traders.

Speculation Regarding Fed Action Grows

As market conditions worsen, speculation regarding early interest rate cuts from the Federal Reserve is gaining traction. Futures markets now indicate the possibility of multiple rate cuts occurring in 2025, with the first likely in May. JPMorgan’s updated economic outlook suggests the Fed may need to act sooner than previously anticipated to mitigate the adverse effects of trade-related disruptions.

However, not all within JPMorgan support an immediate rate cut. CEO Jamie Dimon, in remarks from March 2024, urged the Federal Reserve to hold off on rate reductions until additional economic data becomes available. Dimon emphasized the necessity of waiting for clearer trends in inflation and economic growth, advocating for postponing decisions until at least June.

As policymakers closely observe the Federal Reserve’s actions in the coming weeks, they face the challenge of navigating a complex and rapidly evolving global economic landscape. The Fed’s forthcoming decisions will have profound implications for markets still grappling with uncertainty.